Lewisville's growing economy and population boost its title loan market, attracting lenders and borrowers with increased demand for accessible credit, including truck title loans. Improved financial literacy and digital transformation drive market expansion, predicting higher loan volume and values, better terms for borrowers, and enhanced lending security by 2026. Shifting consumer behaviors and local economic factors will influence demand, while state regulations shape the competitive landscape during this period, offering significant opportunities in Lewisville's title loans sector.

Lewisville’s title loan market has been experiencing steady growth, driven by a combination of economic factors and evolving consumer needs. This article delves into the key drivers behind this expansion, analyzing trends from 2024 to 2026. We explore potential factors shaping future prospects, providing insights into the market’s trajectory and opportunities for stakeholders in the Lewisville title loans sector.

- Analyzing Lewisville's Title Loan Market Growth

- Predicting Trends: 2024-2026 Projections

- Potential Factors Shaping Future Prospects

Analyzing Lewisville's Title Loan Market Growth

Lewisville’s title loan market has been experiencing a steady growth trajectory over the past few years, presenting an exciting opportunity for both lenders and borrowers. This vibrant landscape is largely attributed to the city’s thriving economy and a growing population, which increases the demand for accessible credit options. The appeal of Lewisville title loans lies in their accessibility; they offer a quick and efficient way for individuals to secure funding by using their vehicle’s title as collateral.

With a focus on secured lending, Lewisville has seen a rise in various loan types, including truck title loans, catering to the unique needs of its diverse community. The market’s expansion can also be linked to improved financial literacy and an increasing preference for alternative financing methods. As borrowers explore different options, the competitive nature of the Lewisville title loans sector encourages lenders to offer flexible terms and attractive interest rates, ensuring a robust and healthy growth environment through 2026.

Predicting Trends: 2024-2026 Projections

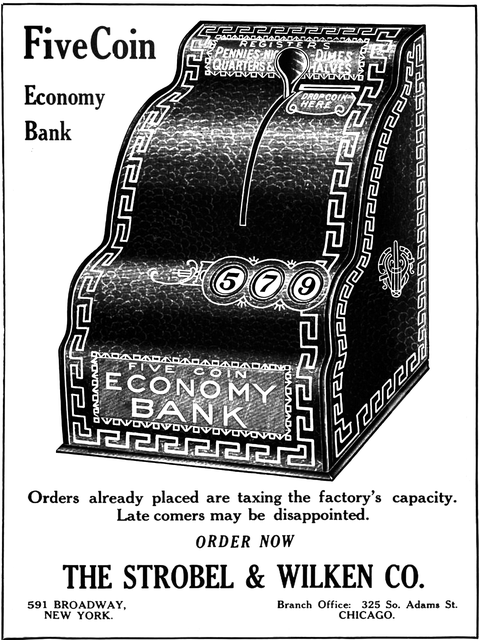

The Lewisville title loans market is poised for significant growth between 2024 and 2026, according to industry forecasts. This projected expansion can be attributed to several factors, including increasing demand for quick liquidity among residents and a growing preference for alternative financing options over traditional bank loans. With the ongoing digital transformation of financial services, Lewisville title loans have become more accessible and appealing to borrowers seeking convenience and faster turnaround times.

Looking ahead, the market is expected to witness a rise in both loan volume and average loan values. As more lenders enter the market, competition will intensify, potentially leading to improved terms for borrowers. Moreover, the integration of advanced vehicle inspection technologies and data analytics can enhance the efficiency of the lending process, ensuring safer and more secure transactions. This period promises to be pivotal for Lewisville’s title loans sector, with opportunities for both established providers and new entrants to capitalize on evolving consumer preferences in Fort Worth Loans and Car Title Loans.

Potential Factors Shaping Future Prospects

The future prospects of Lewisville title loans are shaped by a confluence of economic and social factors. One key determinant is the ongoing evolution of consumer financial behavior. As more individuals recognize the benefits of using their vehicle equity for emergency funds or unforeseen expenses, demand for title loans could see a steady rise. This trend is particularly evident among those who may not have access to traditional banking services or prefer the convenience and speed of alternative lending solutions.

Moreover, regional economic conditions play a significant role. A growing local economy in Lewisville, with low unemployment rates and rising household incomes, could contribute to increased Vehicle Ownership and subsequent interest in title loans. Furthermore, changes in state regulations affecting short-term lending practices may either hinder or boost the market. Balancing these factors will be crucial for lenders operating within the Lewisville title loans sector as they navigate the competitive landscape leading up to 2026.

Lewisville’s title loan market is poised for significant growth through 2026, driven by factors such as economic expansion and evolving consumer needs. Based on current trends and historical data analysis, the forecast predicts a steady increase in demand for Lewisville title loans, presenting both opportunities and challenges for lenders. By staying attuned to key market dynamics and adapting strategies accordingly, participants can capitalize on this vibrant segment, ensuring a robust future within the Lewisville title loans landscape.